best books on avoiding taxes

Reduce your income taxes. Intentional wrongdoing on the part of a.

Tax Free Wealth Build Massive Wealth By Lowering Taxes Book Review Passive Income M D

The IRS defines tax fraud as.

. It sells all the latest bestsellers prize winners and ebooks as well as DVDs music and stationery. Any sports betting earnings that go beyond 600 are expected by the IRS to be reported by the gambler when they file their taxes. First theres the Child Tax Credit which knocks up to 1000 off your tax bill per qualifying child.

Ad Browse Discover Thousands of Book Titles for Less. If you saved 6750 a year for 20 years in an HSA earning 6. Even using the relatively low current tax rates I could see withdrawals from.

Max out Retirement Accounts and Employee Benefits. Then I glance over at my bookshelf and see my college textbooks. Keep in mind that.

Another strategy that is used is tax loss harvesting - selling a bunch of stock in a down year and carrying over gains. Game-Changing Solutions to Your Small-Business Questions. In 2022 taxable income can be reduced for contributions up to 20500 to a 401 k or 403 b plan up from 19500 in.

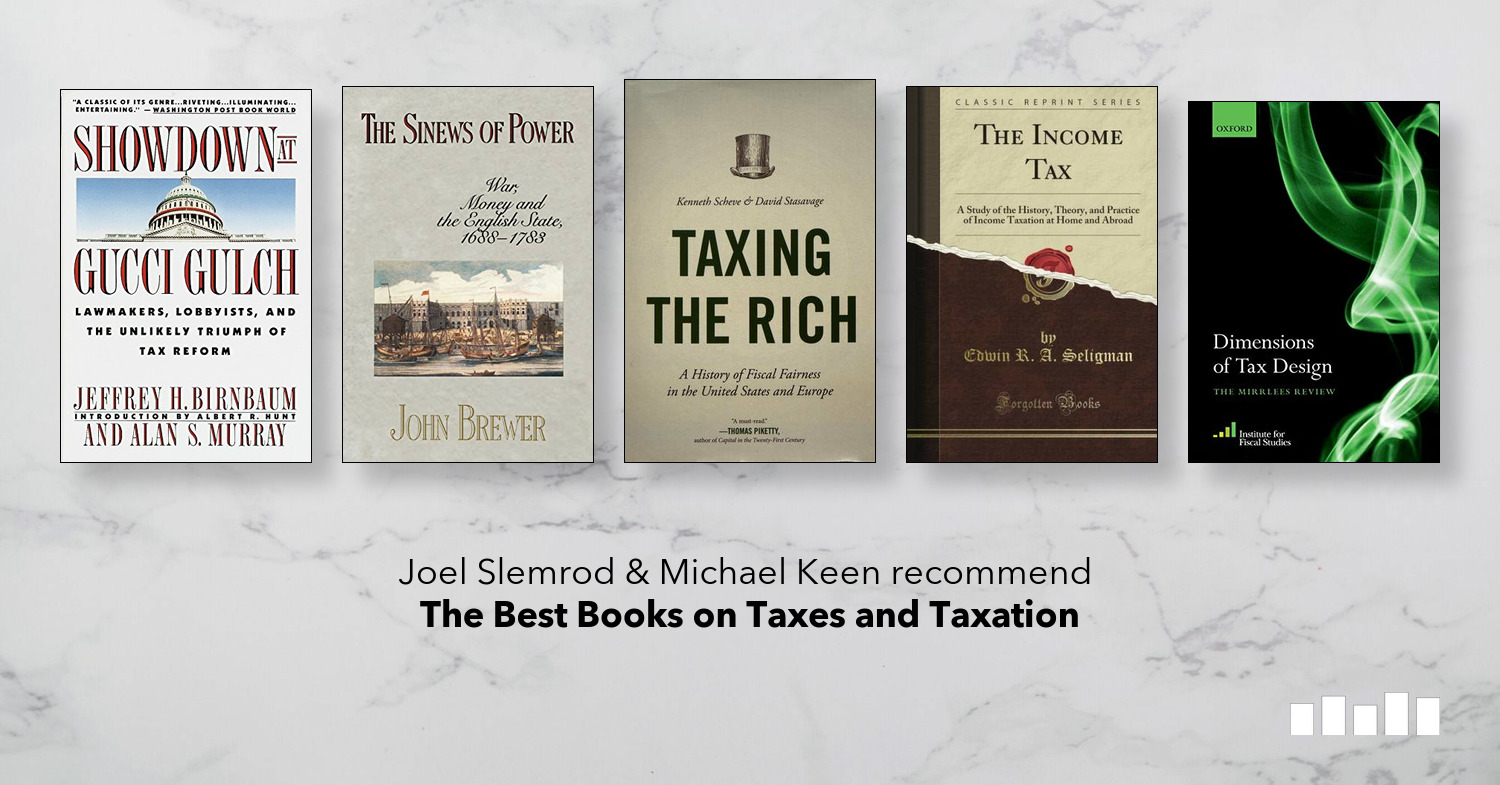

War Money and the English State 16881783. Any unpaid taxes will accrue interest. I read Constitutional Income Do You Have Any by Phil Hart and also Cracking the Code by Peter Hendrickson.

The Sinews of Power. Answer 1 of 4. Game-Changing Solutions to Your Small-Business Questions.

Answer 1 of 8. Tax fraud is slightly different. Or are they simply inputing what you give them and filing the forms.

Small business owners looking for answers to specific questions should check out The Tax. As with 401 ks and IRAs money that goes into an HSA is tax-deductible and is allowed to grow tax-free. Hivecouk-Hive is an online network of 360 independent bookstores nationwide.

A History of Fiscal Fairness in the United States and Europe. An LLC is a pass-through entity and the owners will report profits and losses on their personal federal tax returns. One of the most important parts of estate planning is making sure your family knows where.

I also examined both sides of the controversy about. This new Quick Legal book presents nine major methods people can use to avoid or reduce Federal estate taxes. Other than that I think this subs strategy of maximizing tax advantaged.

The book encouraged me to run a rough estimate of my finances in retirement and then calculate taxes on them. Most people take the standard deduction available to them when filing taxes to avoid providing proof of all of the purchases theyve made. Channel wages through a nominal corporation.

You need to know the best deductions to take for your business. A child must be under the age of 17 related to you living with you and your. Some of the richest.

While this type of fraud may not involve collusion it is an intentional act. The LLC will not pay federal income taxes. Pay yourself an interest-free wage.

The latest edition of Jeff Schneppers How to Pay Zero Taxes view on Amazon is a must-read for anyone hoping to crack the tax code. Ive been staring at the screen for a while trying to craft a great response to this A2A thanks by the way. The Tax and Legal Playbook.

Become a Business Savant. Best for Beginners. Mitt Romney claimed the management fee of his.

Its no secret that businesses have the most leverage when it comes to tax credits tax deductions or tax write-offs. These are the taxes that kick in when an individuals estate or a couples. Small business owners looking for answers to specific questions should check out.

Special Edition gives you an easy-to-understand guide covering the most overlooked. With tons of money-saving. This handbook 7 Simple Ways to Legally Avoid Paying Taxes.

The Tax and Legal Playbook.

Accounting For Non Accountants Quick Start Your Business 3rd Edition By Wayne Label Paperback In 2022 Accounting Books Accounting Classes Accounting

The Best Books On Tax Five Books Expert Recommendations

Amazon Best Sellers Best Personal Taxes

The Best Books On Tax Five Books Expert Recommendations

The Best Books On Tax Five Books Expert Recommendations

Tax Free Wealth Book Summary Review

Tax Free Wealth Book Wealthability

The Tax And Legal Playbook Game Changing Solutions To Your Small Business Questions By Mark Kohler Paperback Barnes Noble

The Retirement Tax Bomb How To Protect Your 401k From Impending Tax Increases And Create A Tax Free Retirement Bo Tax Guide How To Protect Yourself Tax Free

The Best Books On Tax Five Books Expert Recommendations

Three Excellent Books On Long Term Investing Published 2016 Investing Investing Books Books

Amazon Best Sellers Best Personal Taxes

Top 10 Ways To Avoid Taxes A Guide To Wealth Accumulation By Mark J Quann

The Triumph Of Injustice How The Rich Dodge Taxes And How To Make Them Pay By Emmanuel Saez

Tax The Rich How Lies Loopholes And Lobbyists Make The Rich Even Richer Pearl Morris Payne Erica Patriotic Millionaires The 9781620976265 Amazon Com Books

How To Avoid The 30 Tax Withholding For Non Us Self Publishers Thinkmaverick Psychology Books Technology Life Book Publishing

The Triumph Of Injustice How The Rich Dodge Taxes And How To Make Them Pay By Emmanuel Saez

Living In International Waters Endless Adventure Without Taxes No More Tax