irs tax levy letter

For a Notice of Federal Tax Lien you have likely received a Form. The IRS is required to release a levy if it determines that.

What Is An Irs Levy And How Do I Fight It Tax Defense Ohio

In order for the.

. The IRS is required to notify you again prior to levy whenever any new ie additional tax assessments are applied to your IRS account. You paid the amount you owe and no longer have a balance. A levy is a legal seizure of your property to satisfy a tax debt.

It is different from a lien while a lien makes a claim to your assets. Its usually best to call the number on your IRS notice. A notice of levy from IRS is also called an IRS notice of intent to seize your property.

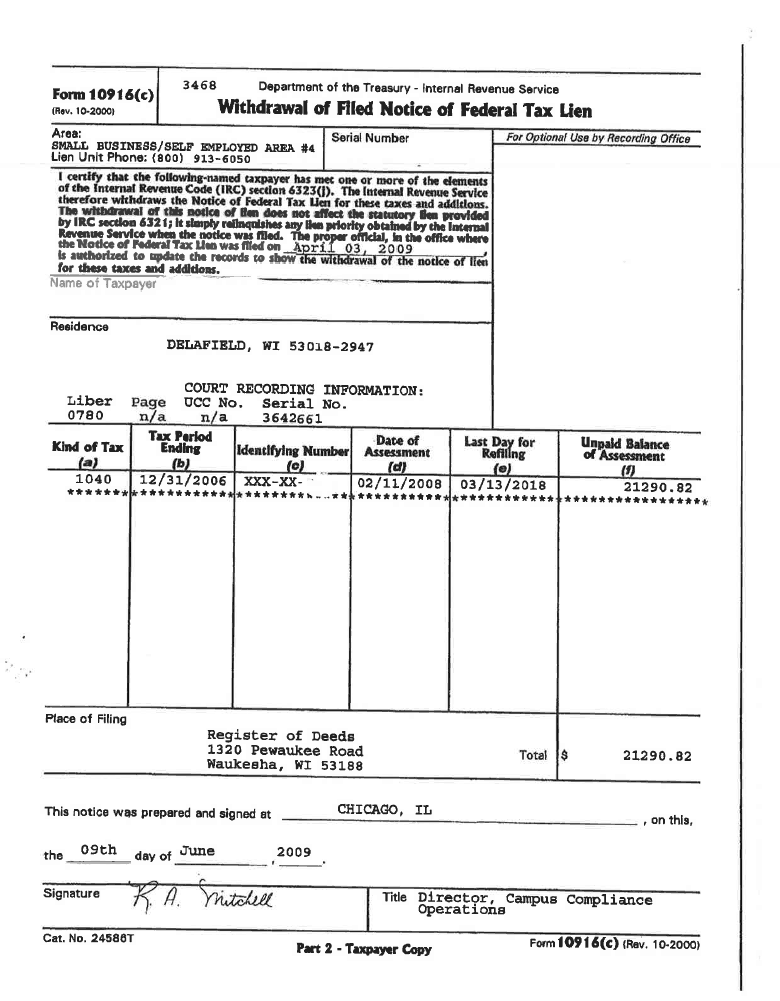

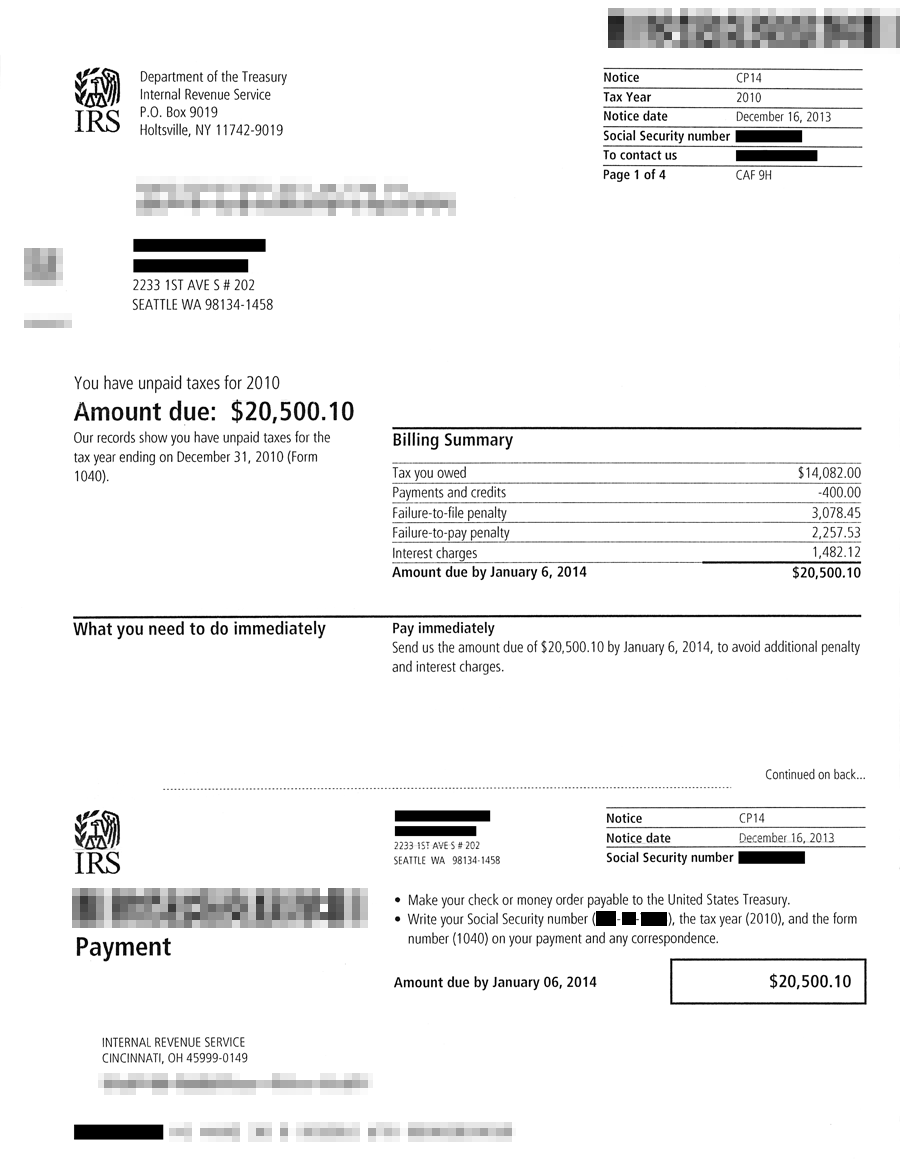

Letter 3172 Notice of Federal Tax Lien Filing and Your Rights to a Hearing under IRC 6320. The IRS notifies you of its intent to levy by. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

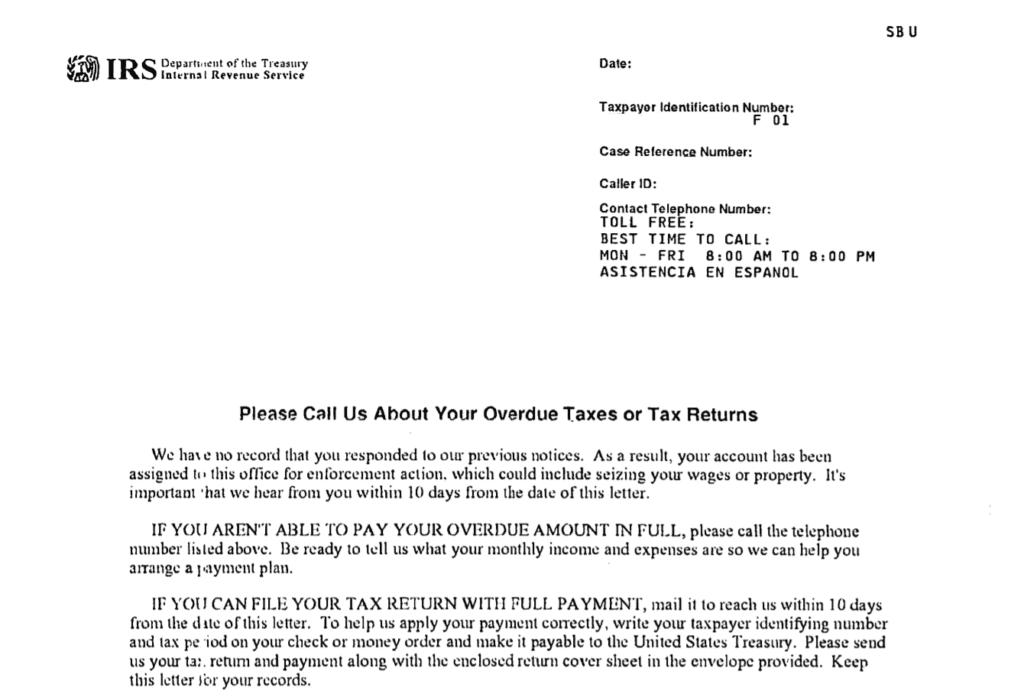

This letter hereby notifies you that we have received an IRS Tax Levy to withhold from your wages. This is the letter you receive before the IRS levies your assets. If the levy is from the IRS and your property or.

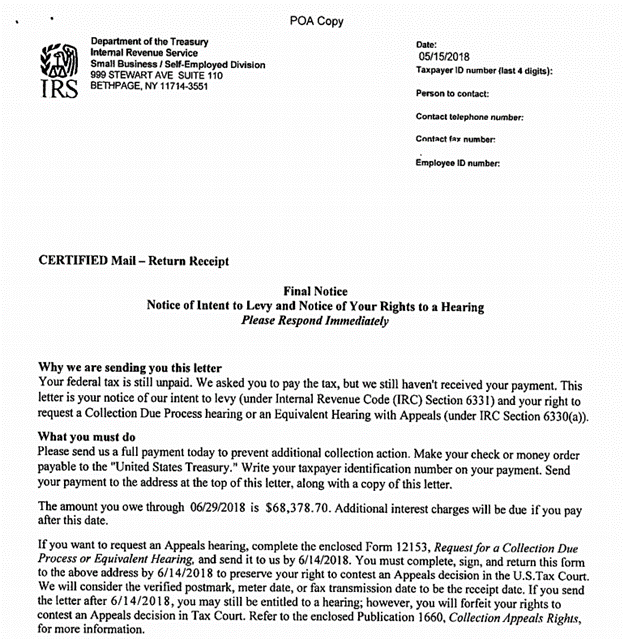

If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing contact the. An IRS Notice of Levy is a letter sent to taxpayers who have not paid their back taxes and have an IRS lien placed against them. A lien is a legal claim against property to secure payment of the tax debt while a.

It is different from a lien while a lien makes a claim to your assets as. The notice may tell you that the IRS plans. What is the IRS levy phone number.

Its a document that communicates the IRS. For a Notice of Deficiency you have likely received either a Letter 3219 Letter 3219N Letter 950DO or Letter 1862. Even if you think you do not owe the tax bill you should contact the IRS.

For example if you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. The first thing to do is to check the return address to be sure its from the Internal Revenue Service and not another agency. The IRS uses several phone numbers depending on the reason for the levy.

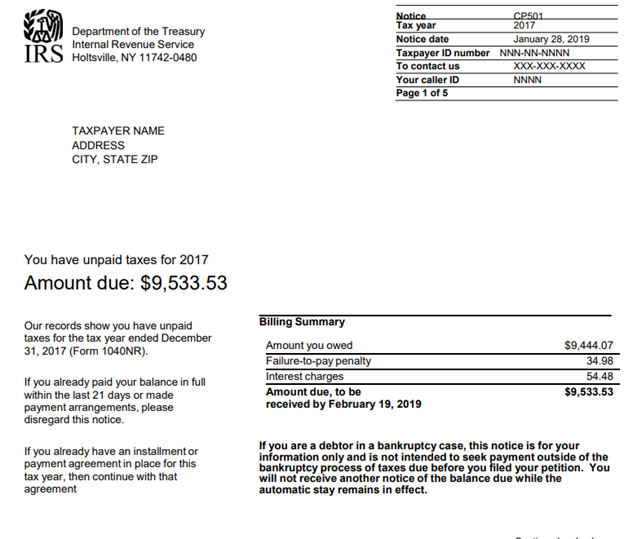

Levies are different from liens. Taxpayers who owe federal back taxes and havent worked with the IRS to find a solution could receive a Notice of Intent to Levy. The IRS is notifying the delinquent taxpayer that they will begin.

The period the IRS can collect the tax ended before the levy. By receiving an IRS Final letter of Intent to Levy from the IRS you have entered the advanced phases of the agencys collection process for tax debt settlement. This letter is required by IRC 6331 before the IRS issues a levy unless collection is in jeopardy to collect tax from most sources.

Federal tax levies have priority over all other liens with the exception of child support. Taxpayers are not entitled to a pre-levy hearing. This letter is to notify you the IRS filed a notice of tax lien for the unpaid taxes.

5 12 3 Lien Release And Related Topics Internal Revenue Service

Irs Tax Letters Explained Landmark Tax Group

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Irs Final Notice Of Intent To Levy Letter 1058 Or Notice Lt11 Larson Tax Relief

Irs Tax Levies Franskoviak Tax Solutions Solving Tax Levy Issues

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Our Case Results Landmark Tax Group

Appealing An Irs Tax Levy When And How To Request

Texas Irs Tax Levy Lawyer Liens Wage Garnishment San Antonio New Braunfels Boerne Kerrville Tx

Irs Audit Letter Cp23 Sample 1

Irs Notice Cp523 Understanding Irs Notice Cp 523 Intent To Terminate Your Installment Agreement Seize Your Assets Pending

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm

List Of Authentic Irs Cp Notices Tax Defense Group

Tax Letters Washington Tax Services

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Irs Audit Letter Cp92 Sample 1

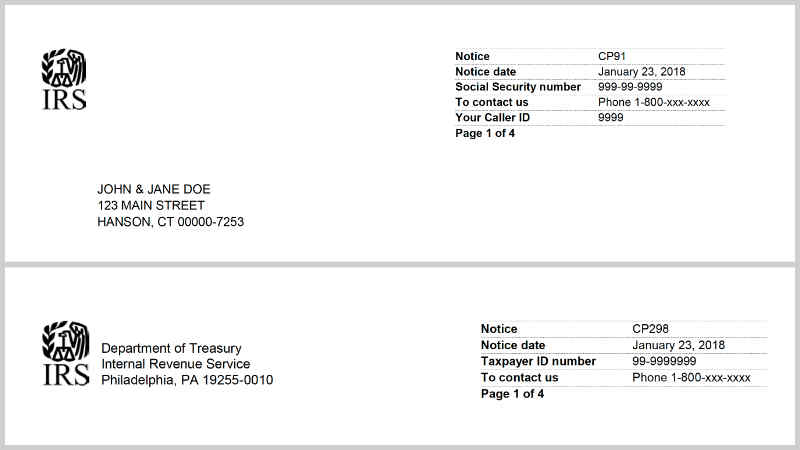

Notice Cp 91 298 Final Notice Before Levy Of Social Security Benefits Tax Defense Group